Tesla shareholders were dealt a stunning blow this week. The electric vehicle giant’s stock fell by 14% in a matter of days. This sharp decline erased over $153 billion from Tesla’s market capitalization. The Musk-Trump dispute has sent shockwaves through the financial world, triggering massive volatility in Tesla’s stock.

The drop came after a fierce public dispute between Elon Musk and former U.S. President Donald Trump. The feud stemmed from differences over electric vehicle subsidies and recent political developments. The argument spiraled quickly, with Musk making bold accusations and Trump responding with harsh criticisms.

How the Musk-Trump Dispute Escalated

The trouble began with Musk criticizing Trump’s support of a spending bill. The bill would reportedly remove certain subsidies benefiting electric vehicle makers like Tesla. Musk responded by slamming the legislation and directly calling out Trump.

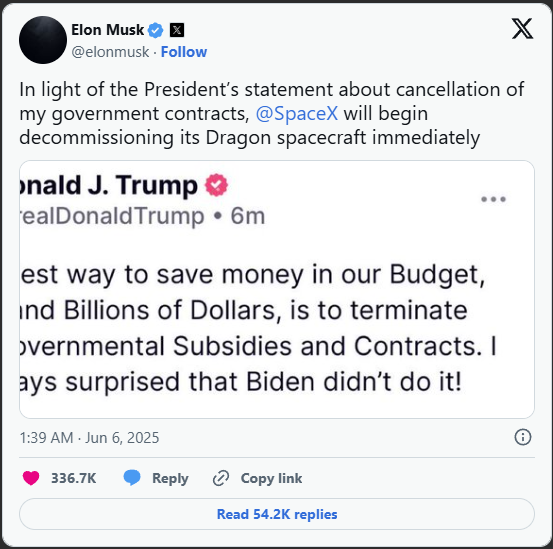

“In light of the President’s statement about cancellation of my government contracts, @SpaceX will begin decommissioning its Dragon spacecraft immediately,” Mr Musk posted on X.

In a series of social media posts, Musk accused Trump of trying to undercut Tesla’s position in the EV market. He didn’t stop there. Musk suggested Trump had ties to figures listed in the controversial Jeffrey Epstein files. This sparked widespread reactions and media attention.

Trump responded with fury. He dismissed Musk’s claims and labeled him as “deranged.” Trump even went as far as to call for a review of Tesla’s government contracts. This dramatic back-and-forth made headlines globally and spooked investors.

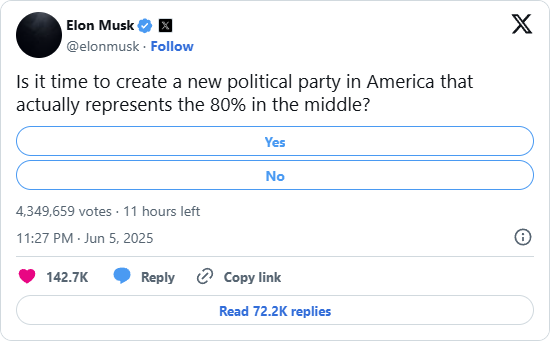

Musk asked his followers a direct question: “Is it time to create a new political party in America that actually represents the 80% in the middle?”

Investor Confidence Shattered

Confidence in Tesla has always been tied to Elon Musk’s actions. His bold moves often excite markets. However, this time the effect was negative. Investors reacted swiftly to the feud’s intensity.

Some analysts noted that Tesla’s fundamentals had not changed. Sales numbers and production rates remained strong. Yet the fear of government retaliation created uncertainty. That uncertainty triggered panic selling on Wall Street.

Several large funds began offloading Tesla shares. The rapid sell-off deepened the loss. Within 48 hours, Tesla had shed $153 billion in market value. Elon Musk’s net worth also took a hit, dropping significantly due to the stock slump.

Possible Legal and Political Fallout

The feud is not only financial. It could also spark legal and political consequences. If Trump or his allies gain influence again, Tesla could be targeted. Potential audits or policy shifts may be aimed at weakening the company’s standing.

There’s also speculation about investigations into Musk’s Epstein-related claims. Legal experts say Musk must provide clear evidence or face defamation risks. Political analysts believe this feud could become a defining issue in upcoming elections.

As of now, Musk has not backtracked. Instead, he doubled down on his statements. He continues to post online, encouraging transparency and criticizing political power plays. The keyword Tesla Shares Plunge 14% Amid Musk-Trump Dispute began trending across multiple platforms as audiences followed the drama closely.

How It Affects Tesla’s Future

Tesla is no stranger to controversy. Elon Musk’s leadership style is bold, erratic, and often unpredictable. This combination has built the brand but has also created risk. The latest conflict may damage Tesla’s image among moderate investors and regulators.

Some Tesla fans believe this situation will pass. They argue the company’s innovation and technology are too strong to be derailed by politics. However, critics warn that prolonged public feuds could destabilize Tesla’s stock for months.

With the company preparing for new launches, including its next-generation Model 2, timing couldn’t be worse. Tesla needs investor trust, and this public spat has made that harder to secure.

Musk’s Public Persona Under Pressure

Elon Musk’s personal brand is deeply tied to Tesla’s success. His tweets and public statements often drive market reactions. This feud puts that dynamic under strain.

Musk’s decision to drag in political issues has drawn both support and backlash. While some fans admire his boldness, others see it as reckless. Shareholders are divided. Some want Musk to focus solely on Tesla’s business. Others support his call for more political accountability.

Also, read: EcoPlus Fuel Saver Reviews

Stock Market Reactions and Forecasts

Wall Street is watching Tesla closely. Market analysts are split on what comes next. Some believe the stock could rebound if Musk tones down the rhetoric. Others fear more turbulence ahead, especially if Trump escalates the feud.

Several hedge funds reduced their positions in Tesla after the fallout. Retail investors also began exiting. The tech-heavy NASDAQ saw increased volatility as a result of Tesla’s dip.

Still, some experts advise caution rather than panic. They say Tesla’s long-term growth prospects remain solid. But they warn that political distractions could cloud those prospects. It is clear the situation is far from over.

A Key Moment in Musk’s Legacy

This moment could shape how Elon Musk is remembered. Is he the fearless innovator standing against corruption? Or is he the volatile CEO risking billions over personal disputes? Only time will tell. But what’s certain is that the feud has left a mark. Investors, policymakers, and fans will be watching Musk’s next move carefully. Whether he chooses to reconcile, retaliate, or redirect the conversation will have a major impact.

This saga is also a reminder of how quickly business can become political. When powerful figures clash, the ripple effects can shake markets, reputations, and fortunes.

For more on academic leadership controversies, see the detailed coverage of how Santa Ono rejected to lead University of Florida after a high-profile selection process.