As June 2025 unfolds, millions of Americans relying on Social Security payments are keenly watching their bank accounts and mailboxes. This month brings specific payment schedules and some notable changes, particularly for those receiving Supplemental Security Income (SSI) benefits. Understanding these details is crucial for effective financial planning, especially for retirees and individuals with disabilities. Amidst these administrative adjustments, broader discussions about the program’s future, including a potential shift in policy emphasis and comments from prominent figures like Gavin Newsom, continue to shape the national dialogue.

The Social Security Administration (SSA) processes millions of payments every month. This complex system ensures that benefits reach diverse groups, including retired workers, individuals with disabilities, and survivors. While the core function remains consistent, timing can vary based on several factors, making it essential for beneficiaries to stay informed about their specific payment dates and any policy shifts.

Your June 2025 Payment Schedule: A Detailed Look

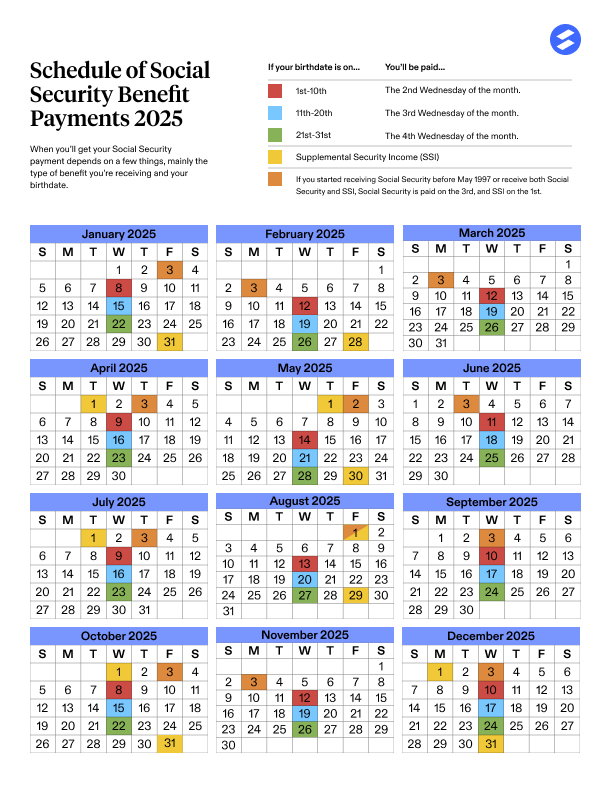

For most Social Security beneficiaries, your payment date in June 2025 directly links to your birth date. This staggered approach helps the SSA manage the immense volume of transactions smoothly.

- For beneficiaries whose birthday falls between the 1st and 10th of any month: You can expect your payment on Wednesday, June 11, 2025. This date applies to a significant portion of the beneficiary population.

- For beneficiaries whose birthday falls between the 11th and 20th of any month: Your payment will arrive on Wednesday, June 18, 2025. Mark your calendars accordingly.

- For beneficiaries whose birthday falls between the 21st and 31st of any month: Look for your payment on Wednesday, June 25, 2025.

There’s a key exception to these birthday-based schedules. If you began receiving Social Security benefits before May 1997, your payment schedule remains consistent. Your June 2025 payment was disbursed on Monday, June 3, 2025. These early recipients always receive their benefits at the start of the month, regardless of their birth date.

Supplemental Security Income (SSI) and the June Anomaly

Supplemental Security Income (SSI) beneficiaries will notice a significant difference in their June 2025 payments. There won’t be a separate SSI payment issued in June. This is not an error or a missed payment; instead, it’s a routine calendar adjustment. The Social Security Administration disbursed June’s SSI payment early, on Friday, May 30, 2025. This happens when the first day of the month falls on a weekend, as June 1, 2025, was a Sunday. To ensure timely access to funds, the SSA moves the payment to the last business day of the preceding month.

This means that SSI recipients received two payments in May: one for May benefits on May 1st, and the early June payment on May 30th. While it may seem like a double payment, it simply adjusts the timing; your total annual benefits remain unchanged. This pre-payment strategy is standard practice and occurs several times throughout the year. Looking ahead, the next SSI payment will be on Tuesday, July 1, 2025.

Other Important Considerations for June 2025

Beyond the standard payment dates, several other factors might impact your Social Security Payments this month or in the near future.

- Student Loan Garnishments Resume: A significant development for approximately 195,000 Social Security recipients is the resumption of federal student loan garnishments. After a five-year pause during the COVID-19 pandemic, the federal government has reactivated its Treasury Offset Program. This allows up to 15% of monthly Social Security benefits to be withheld for individuals who have defaulted on federal student loans. Many beneficiaries received 30-day warning letters in May, indicating that these deductions would begin in June 2025. This policy shift reflects a renewed focus on debt recovery and impacts a substantial number of retirees and individuals with disabilities. If you are in default, exploring options like loan rehabilitation or income-driven repayment plans becomes critical.

- Cost-of-Living Adjustment (COLA): While not a direct change for June, it’s worth remembering that Social Security and SSI benefits saw a 2.5% Cost-of-Living Adjustment (COLA) for 2025. This increase began with January 2025 Social Security benefits and December 31, 2024, for SSI recipients. The COLA helps benefits keep pace with inflation, offering some relief to beneficiaries facing rising costs. Your specific benefit amount reflects this adjustment, which was outlined in COLA notices sent out in December 2024.

- Maximum Benefits and Earnings Limits: For 2025, the maximum Social Security benefit at full retirement age is $3,822 per month. The maximum benefit for someone claiming at age 62 is $2,710, while delaying until age 70 could yield up to $4,822. These figures depend on a worker’s earnings history. Additionally, earnings limits for those working while collecting benefits and who are under full retirement age have increased to $23,400. For every $2 earned above this limit, $1 is deducted from benefits. For those reaching full retirement age in 2025, the limit is $62,160, with $1 deducted for every $3 earned until the month they reach full retirement age. These limits are important for beneficiaries who continue to work.

Long-Term Outlook and Political Discussions

The long-term solvency of the Social Security program remains a consistent topic of national discussion. While not directly impacting June 2025 payments, these conversations influence future policy decisions. Experts and politicians frequently debate potential solutions to ensure the program’s stability for generations to come.

One prominent figure in these discussions is Gavin Newsom. As a leading voice within the Democratic Party and the governor of California, he often weighs in on federal fiscal matters, which implicitly includes Social Security’s future. While Governor Newsom’s direct policy actions primarily concern California, his engagement in national debates on tax policy, federal funding, and the overall economic health of the nation often touch upon the broader safety net programs.

For example, he has recently challenged the federal government on tax contributions from California, emphasizing the state’s significant financial input into federal coffers. These broader fiscal arguments underline the intricate connection between state and federal finances, impacting how federal programs like Social Security are funded and managed. The actions of figures like Gavin Newsom can shape the national conversation around entitlement programs and future reforms.

What to Do If Your Payment is Delayed

If your Social Security or SSI payment does not arrive on its expected date, it’s understandable to feel concerned. The Social Security Administration advises beneficiaries to wait at least three business days after the expected payment date before taking any action. This allows for typical postal or bank processing delays. If the payment still hasn’t arrived after this waiting period, you should contact the SSA directly. You can reach them via their national toll-free number or visit your local Social Security office. For enhanced security and quicker access to funds, the SSA strongly encourages all beneficiaries to sign up for direct deposit. This method minimizes delays and provides a more reliable way to receive your monthly benefits.

Understanding the nuances of Social Security payments, from regular schedules to early disbursements for SSI and the broader implications of policy changes like student loan garnishments, empowers beneficiaries. Staying informed helps individuals manage their finances and prepares them for any future adjustments to this vital program.

Also read: Trump Bans Travel from 12 Countries Amid Rising National Security Fears