Building wealth feels less intimidating when lessinvest .com walks beside you, showing that real diversification is possible on even the tightest budget. By the end of this guide you’ll understand why spreading risk across assets matters, how much you truly need to start, and exactly which low-cost tools can turn pocket change into a portfolio. Stick with me—lessinvest .com appears throughout these 1 500 words as a friendly reference point, and by the time you read it the third time you’ll already have a blueprint to act on.

What Does Diversification Really Mean?

Diversification sounds complex, yet the principle is simple: never let one asset class decide your financial future. When you own only local stocks and a recession hits your country, the fallout can wipe years of savings in weeks, but a global mix cushions the blow. Picture a dinner plate lined with grains, vegetables, proteins, and fruit; a portfolio works the same way when stocks, bonds, real estate, and even tiny slices of crypto share space.

Investors often confuse “owning many stocks” with true diversification, but if all those companies belong to the same industry you’re still at risk. Broader coverage demands several uncorrelated assets so gains in one bucket offset losses elsewhere, leading to smoother returns and calmer sleep. Studies of thirty-year periods show that balanced allocations beat single-asset bets four out of five times and do so with far less volatility, confirming the old saying: variety protects.

Diversification also buys you time; when one sector lags you needn’t panic-sell because something else in the mix likely rises. This cushion lets compounding do its magic, growing modest contributions into sizeable sums over decades. lessinvest .com champions that slow-and-steady philosophy, emphasizing cost-efficient building blocks anyone can afford.

Why Budget Investing Works Better Than You Think

Starting small forces creativity, teaching habits wealthy investors adopt later but seldom learn early. You compare expense ratios, hunt fractional-share brokers, and automate contributions while amounts are tiny, so when income grows processes remain frictionless. Research shows that people who begin investing with under ₹5 000 develop higher lifetime participation rates than those who delay until they have “enough,” proving momentum matters more than starting capital.

Low-fee index funds now allow ownership of thousands of companies for less than the price of dinner, trimming drag that once made small portfolios unviable. Commission-free apps, zero-minimum bond ETFs, and digital REIT platforms further democratize access, meaning budget investors can mirror the asset spread of large institutions at negligible cost. The only missing ingredient is discipline—a trait built through regular micro-deposits rather than occasional lump sums.

Finally, budget portfolios encourage dollar-cost averaging, reducing timing risk by spreading buys across market cycles. Historical data confirms that workers who invest modest amounts monthly accumulate larger balances than peers who wait for the “perfect entry point” but never pull the trigger. lessinvest .com embeds calculators that illustrate this effect, reinforcing confidence that small steps compound.

Core Asset Classes for Small Budgets

Stocks: Index Funds and Fractional Shares

Owning equities begins with broad-market ETFs such as an all-country world index, often costing under 0.10 % annually. Fractional trading means ₹100 buys the same percentage exposure as ₹10 000, removing barriers once posed by high share prices. Three-sentence wisdom: focus on low fees, stay diversified across sectors, and hold long enough to ride out downturns.

Bonds: Low-Cost Bond ETFs

Bonds stabilize portfolios, supplying income when stocks swoon. Look for government or aggregate bond ETFs with maturities staggered to reduce duration risk. Expense ratios below 0.15 % keep more yield in your pocket, an especially big deal for small balances.

REITs: Real Estate Without Mortgages

Real Estate Investment Trusts let you tap rental markets with a click, spreading money across offices, warehouses, and apartments worldwide. Many REIT ETFs yield 3 – 5 %, cushioning volatility from equities. Diversify across subsectors to avoid over-reliance on retail malls or any single property type.

Commodities and Gold

A modest slice of commodities—often 5 – 10 %—hedges inflation that erodes bond coupons. Gold ETFs track physical bullion, while broad commodity funds cover energy and agriculture in one ticket. Allocate sparingly; their main role is insurance, not outsized growth.

Cash and Money-Market Funds

Never dismiss cash, the powder you deploy when markets discount quality assets. High-yield savings or treasury-backed funds currently pay better than many fixed deposits, offering liquidity for emergencies. Keep three months of expenses separate from your investment account to avoid forced selling.

Crypto (Optional but Growing)

Digital assets remain volatile, yet a 1 – 2 % allocation can boost risk-adjusted returns if rebalanced. Use reputable exchanges and hardware wallets to mitigate custody hazards. Invest only money you can afford to watch swing 50 % in a week.

Quick Snapshot of Core Assets

| Asset Class | Typical Minimum (₹) | Avg. Annual Return* | Liquidity | Key Risk |

|---|---|---|---|---|

| Global Stock ETF | 100 | 8 – 10 % | T+2 days | Market crashes |

| Bond ETF | 100 | 3 – 5 % | T+2 days | Interest-rate spikes |

| REIT ETF | 100 | 6 – 8 % | T+2 days | Property downturn |

| Gold ETF | 100 | 5 % | T+2 days | Commodity swings |

| Money-Market | 100 | 4 % | Same day | Inflation erosion |

| Crypto | 100 | 12 %+ | 24/7 | Extreme volatility |

*Historical averages, not guarantees.

Step-by-Step Guide to Building Your Starter Portfolio

Set clear goals before choosing funds because strategy drives selection, not the other way around. Decide whether you’re saving for a home down payment in five years, retirement in thirty, or a child’s college in fifteen, and anchor risk tolerance to timeline. Next, pick a low-cost broker that supports fractional ETFs and automatic transfers, two features indispensable for budget diversification.

Open separate “core” and “explore” sub-accounts so speculative ideas never crowd out disciplined holdings. Automate a monthly contribution equal to at least 10 % of income, splitting money according to your target allocation template. Rebalance once or twice a year, trimming overweight winners and topping up laggards to maintain risk profile; most platforms provide one-click rebalancing.

When windfalls arrive—tax refunds or bonuses—treat them as accelerants rather than excuses to overhaul allocations. Route 50 % toward your existing portfolio and 50 % toward experiences or debt reduction, balancing life enjoyment with future growth. Over time, raise contribution rates whenever income rises, letting percentage increases rather than lifestyle creep drive net-worth leaps.

Bullet Checklist: Tools That Make It Easy

- Auto-invest settings that buy ETFs monthly without manual orders

- Expense-ratio comparison widgets built into lessinvest .com dashboards

- Goal trackers that show projected balances at various contribution rates

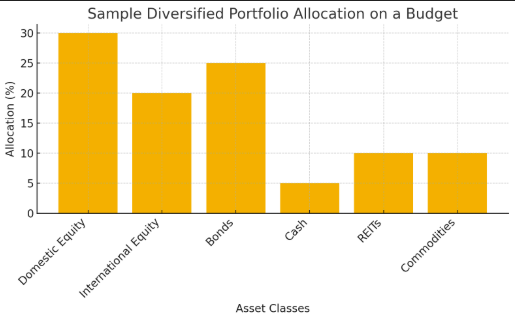

Chart Insight

The bar chart above visualizes a sample allocation: 30 % domestic equity, 20 % international equity, 25 % bonds, 10 % REITs, 10 % commodities, and 5 % cash. Notice how no single slice exceeds one-third of the pie, a hallmark of balanced exposure. Even if equities slump, the remaining 70 % provides ballast, illustrating diversification in action.

Frequently Asked Questions

How much money do I need to start using lessinvest .com strategies?

Most brokers let you buy fractional ETFs for under ₹100, so beginning truly costs less than a weekend meal. What matters is consistency rather than size because compounding works on every rupee. Over time, scaling contributions matters more than picking the “perfect” fund.

Are index funds really safer than individual stocks?

Index funds still carry market risk, yet they remove single-company risk that devastates concentrated portfolios. By holding thousands of firms, you rely on global economic growth instead of one CEO’s decisions. Expense ratios stay minimal, so gains compound with fewer leaks.

How often should I rebalance a small portfolio?

Twice a year suits most investors, striking a balance between discipline and transaction drag. Rebalancing more frequently rarely improves returns unless markets act wildly, while doing it less may allow drift to distort risk. Many apps automate thresholds, selling only when an asset drifts 5 % beyond target.

Can I diversify without buying bonds?

You can, but volatility will jump because bonds offset equity swings and provide income. If your horizon exceeds twenty years, you might lower bond exposure, yet zero allocation often leads to emotional selling during crashes. Even a 10 % bond slice can soften drawdowns.

Final Thoughts

Diversification doesn’t demand deep pockets; it demands intention, regularity, and low fees—all pillars lessinvest .com champions. Start with broad ETFs, sprinkle stabilizers like bonds and gold, and stay faithful to your plan through market noise. Your future self will thank you for planting seeds today that blossom into financial freedom tomorrow.

For more practical tips on saving and growing your money alongside budget investing, you can also check out money6x .com for additional insights and strategies.